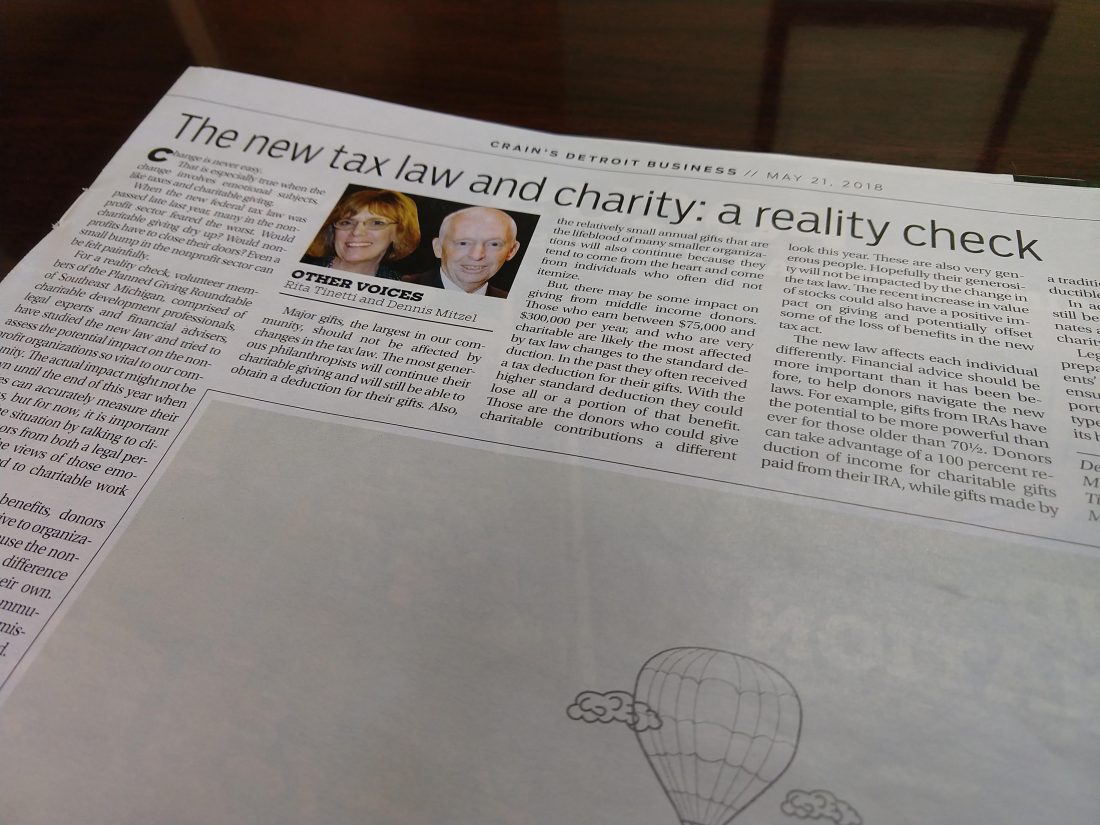

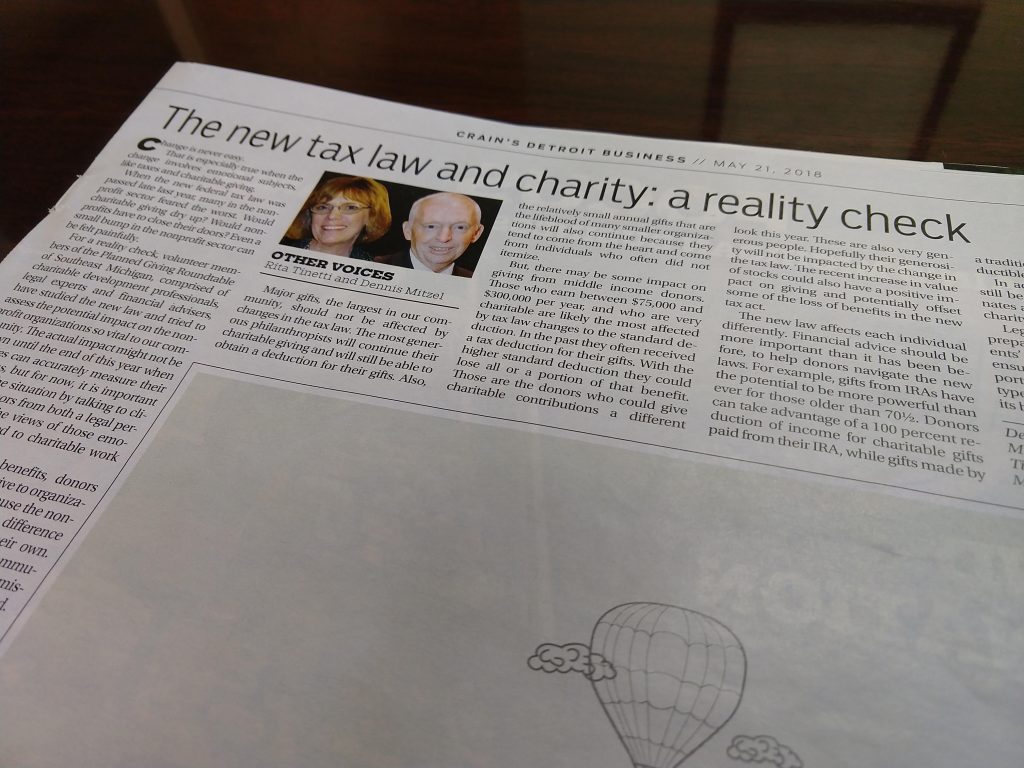

Tax Law and Charitable Giving

In an article published by Crain’s Detroit Business on May 21, 2018, attorney Dennis Mitzel along with co-author Rita Tinetti discuss the potential effects of recent tax law changes on charitable giving. Although the ultimate effects are currently unknown, Dennis and Rita believe the new tax law will largely impact middle income donors (earning between $75,000 and $300,000 per year) more than any other individuals. Because of the new tax law changes it is recommended that donors consult with their financial and legal advisers to understand their options. You can read the entire article here: The New Tax Law and Charity: A Reality Check.

Dennis is a member of the Planned Giving Roundtable of Southeast Michigan whose organization purpose is to “increase the use of planned gifts as tools for support of charitable organizations through the dissemination of information regarding the advantages and techniques of planned giving.”

If you have questions about recent tax law changes involving charitable giving, please contact our office.

Dennis M. Mitzel is the principal of the Mitzel Law Group PLC law firm and former partner with the Berry Moorman P.C. law firm. Dennis was an estate and gift tax attorney for the Internal Revenue Service in Detroit, Michigan from 1977 to 1981. He was then an Assistant Vice President with Comerica Bank in Detroit, where he headed the Estate Tax Division of the Trust Tax Department.